WeChat ID :

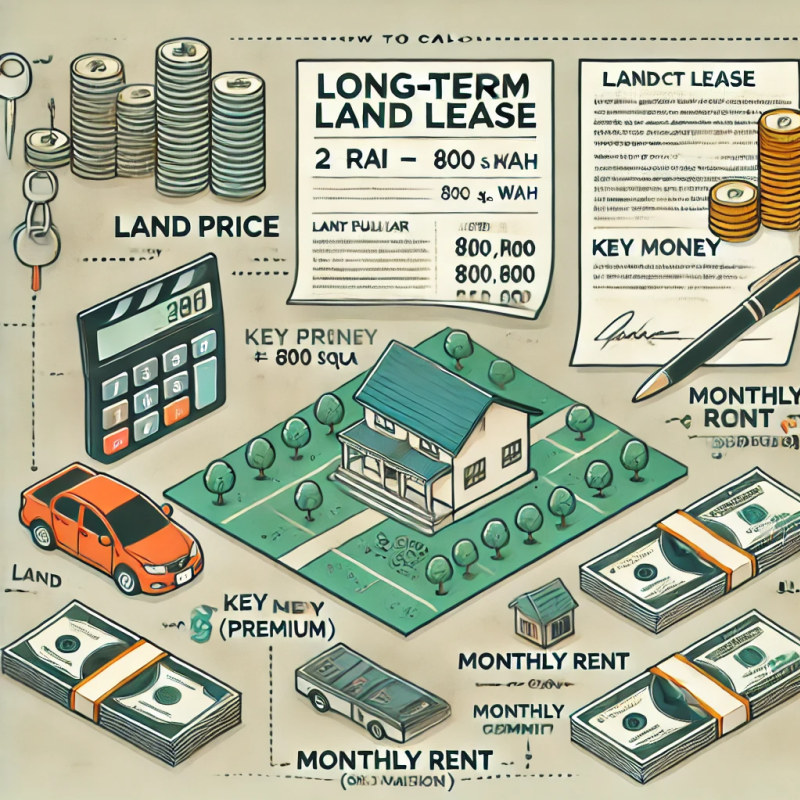

A guide to understanding rent pricing for long-term land leases (e.g., 20 years), key money, and agent commissions—complete with formulas and examples.

Find the market selling price per square wah (Thai land unit) in the same zone or nearby.

Use real estate websites to estimate this.

Example: Land price = 300,000 THB per sq.wah

For 800 sq.wah (2 rai):

300,000 × 800 = 240 million THB (land market value)

Determine rental value based on a percentage of land price

For long-term leases, use 40%–60% of the land’s value.

For a 20-year lease, assume 50%: 50% of 240M = 120M THB over 20 years

Convert to annual and monthly rent

Annual: 120M ÷ 20 = 6M THB/year

Monthly: 6M ÷ 12 = 500,000 THB/month

📌 Formula:

(Land Sale Price × 40–60%) ÷ Lease Years ÷ 12 = Monthly Rent

Key money (or premium) is a one-time payment to compensate the landowner for the opportunity cost of locking their land.

Not fixed by law—usually ranges from 10%–30% of land value

Based on lease duration:

10% for 10 years

20% for 20 years

30% for 30 years

📌 Example:

If land price is 240M THB and lease is for 20 years:

20% × 240M = 48M THB as key money

There are two scenarios:

5% of key money

Plus 2 months of rent

Example:

Key Money = 24M → 5% = 1.2M

2 months rent = 500k × 2 = 1M

Total commission = 2.2M THB

2% of total lease value over the entire lease period

(e.g., 500k/month × 12 months × 20 years = 120M)

2% of 120M = 2.4M THB

Long-term leases must be registered with the Land Department.

Registration fee: 1.1% of the total rent over the lease period.

Avoid doing “3+3+3” years (rolling leases) to skip fees—if a legal issue arises, the law only protects the first 3 years.

Join the discussion at

https://www.facebook.com/665933695/posts/10162006366048696/?mibextid=wwXIfr&rdid=tcJfhcwG2rmLi66j#